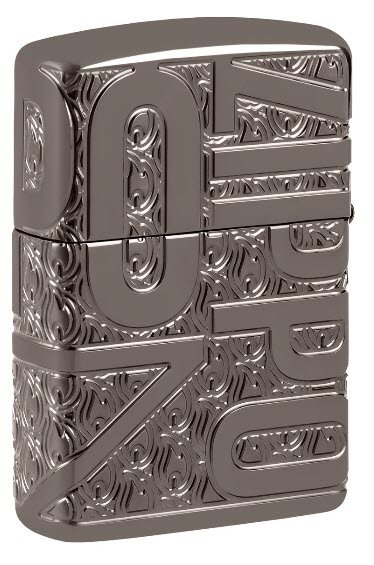

Zippo Armor Reverse Carve Zippo Design, No. 46312

To Chloris

Youn has a great touch… love the pacing.

Chloris was a Nymph associated with spring, flowers and new growth, believed to have dwelt in the Elysian Fields. Roman authors equated her with the goddess Flora, suggesting that the initial sound of her name may have got altered by Latin speakers (a popular etymology). Myths had it that she was abducted by (and later married) Zephyrus, the god of the west wind. She was also thought to have been responsible for the transformations of Adonis, Attis, Crocus, Hyacinthus and Narcissus into flowers.

S'il est vrai, Chloris, que tu m'aimes,

Mais j'entends, que tu m'aimes bien,

Je ne crois point que les rois mêmes

Aient un bonheur pareil au mien.

Que la mort serait importune

De venir changer ma fortune

A la félicité des cieux!

Tout ce qu'on dit de l'ambroisie

Ne touche point ma fantaisie

Au prix des grâces de tes yeux.

Questions and Concerns Regarding Indicia of Potential Manipulation

U.S. SECURITIES AND EXCHANGE COMMISSION Washington, D.C.

SECURITIES EXCHANGE ACT OF 1934

Release No. 101272 / October 7, 2024

The Securities and Exchange Commission announced the temporary suspension, pursuant to Section 12(k) of the Securities Exchange Act of 1934, of trading in the securities of Chanson International Holding (“Chanson”) (CIK No. 1825349), a holding company incorporated in the Cayman Islands whose principal executive offices are located in Urumqi, Xinjiang, China, at 4:00 a.m. EDT on October 8, 2024, and terminating at 11:59 p.m. EDT on October 21, 2024.

The Commission temporarily suspended trading in the securities of Chanson because of questions and concerns regarding indicia of potential manipulation in the securities of Chanson effectuated through recommendations, made to investors by unknown persons via social media to purchase the securities of Chanson, which appear to be designed to artificially inflate the price and volume of the securities of Chanson. The order was entered pursuant to Section 12(k) of the Exchange Act.

The Commission cautions broker-dealers, shareholders, and prospective purchasers that they should carefully consider the foregoing information along with all other currently available information and any information subsequently issued by the company.

If any broker-dealer or other person has any information that may relate to this matter, they should immediately contact the Boston Regional Office of the Commission at boston@sec.gov.

UNITED STATES OF AMERICA

Before the SECURITIES AND EXCHANGE COMMISSION

October 7, 2024

____________________________________

IN THE MATTER OF : CHANSON INTERNATIONAL HOLDING :

____________________________________

ORDER OF SUSPENSION OF TRADING

It appears to the Securities and Exchange Commission that the public interest and the protection of investors require a suspension in the trading of the securities of Chanson International Holding (“Chanson”) (CIK No. 1825349), a holding company incorporated in the Cayman Islands whose principal executive offices are located in Urumqi, Xinjiang, China, because of questions and concerns regarding indicia of potential manipulation in the securities of Chanson effectuated through recommendations, made to investors by unknown persons via social media to purchase the securities of Chanson, which appear to be designed to artificially inflate the price and volume of the securities of Chanson. As of October 7, 2024, the common stock of Chanson is listed on the Nasdaq Capital Market under the symbol “CHSN.” The Commission is of the opinion that the public interest and the protection of investors require a suspension of trading in the securities of the above-listed company.

THEREFORE, IT IS ORDERED, pursuant to Section 12(k) of the Exchange Act, that trading in the securities of the above-listed company is suspended for the period from 4:00 a.m. EDT on October 8, 2024, through 11:59 p.m. EDT on October 21, 2024.

By the Commission.

Vanessa A. Countryman

Secretary

Movies Watched -- Paper Moon (1973)

102 minute running time… Peter Bogdanovich movie … I don’t like movies with kids in them… this probably wasn’t that terrible, but I didn’t make it very far in before going to fast forward. John Farr found it hilarious, but I beg to differ.

She don’t believe in puttin’ out fer free.

Movies Watched -- The Teachers' Lounge (2023)

In German. 98 minute running time, so the perfect length. I wasn’t super thrilled with this. It’s a political picture. Germany is really grappling with being a multi-cultural society now. And things are getting more litigious. One thing you can say for sure is that the German public school system is NOT underfunded.

Makes sense that the director is a Turk who was born and raised in Berlin. Leonie Benesch, the star of this movie, played Eva in The White Ribbon, which is a great movie. The Teachers’ Lounge was a John Farr reco, but I do not second it…

Movies Watched -- Birth (2004)

100 minute running time so the perfect length … I’m a huge fan of Jonathan Glazer, but had never seen his second movie, Birth. It is a weird one and the mainstream critics HATED it, but I didn’t mind it, in fact I liked it, it’s definitely NOT terrible, and I’ve added a copy to my permanent collection. I love Nicole Kidman, she’s super talented. It’s a love story, but a twisted one. I would recommend it if you like Glazer and are a completist like me. Green-go!

[Not just the Wagner getting to her]

Zippo Armor James Bond 007 Goldfinger 60th Anniversary Collectible, No. 46467

Notes from Interview with Day Trader: kycefn

Kyce was playing competitive Fortnight

Found trading at age 18

Has a southern accent, mild enough to be North Carolinan?

Joined buddies trading halfway through 2020

Has three brothers, plays competitive soccer

Parents expected all As, otherwise gave him a lot of freedom

Two older brothers

Tried eBay re-selling biz, failed

Tried dropshipping store in high school, failed

Tried math tutoring, also failed

Trading is the highest skill gap game out there

Keeps up with original trading group, a couple still trade 5 6 7 years later

"Great dudes"

Read Mark Minervini books

Went heavily into Reddit and Twitter, thinks TWTR best for finding real traders

Went to college for a year and half, online

Halfway through 2021 went back to in-person school, went one semester

Studied engineering, missed trading, dropped out

Went full time trading start of 2022

March April 2022 first profitable months, $1K-$2K a month

Keep size small when you start

Journaling the most important thing

"Mistake tracking"

Focused only on the losing trades at end of month

"No trading under VWAP"

"No trading first 15 minutes"

"No trading low volume stocks"

Every month he would add a new rule to eliminate losses

Profit factor went from 1 to 3 over the course of the year 2022

He's long only and small caps only

Scalps last 5 to 30 minutes

2024 has added discretionary swings on the side

2022 never traded pennies

2023 added pennies back slowly

2024 also trades pennies and stocks over $10

2024 can comfortably scalp while spending more time on swing ideas

GME personal record trade in June 2024, got long June 4 and added June 5

GME sold into the parabolic move on June 6, 2024, then re-longed it sold most AH in $60s

You have to be OK with missing trades

Wakes up just before open, lets dust settle, then looks for plays with volume

Works out, stays active, all routines he follows

TradeIdeas is essential, a huge tool

Use ThinkOrSwim's scanner if you can't afford TradeIdeas

Real edge is being discussed on Twitter if you filter out nonsense

Not a rigid weekly or monthly "mistake tracking" session now, but he still looks over things

He finds a tilt trade or two and will force self memorize the chart of worst trades

Writing things down helped him a lot

2022 2023 wrote a lot on daytrading subreddit

He is a long only discretionary scalper

Always have a max loss... 20-30 average green day number, double or triple it = max loss

Could only lose 2 or 3 ave green days before locking self out, used self control to stop trading

Trusts his mental stops

Red day meant half size the next day

A drawdown feels like the world is ending

Size down and take it slow

Does NOT have a broker max loss

Fear and shame keeps him from disrespecting his max loss

Need to address underlying issues if you need broker max loss

Sizing up he has written about on Reddit

Sizing up is very individual... has to do with your mind/subconscious

You will naturally get more comfortable in small steps

Sizing should not be robotic, you have to feel good emotionally, risk your "profits"

His greatest strength is patience

Best advice: start small!

You should quit trading if you are considering quitting, quit and reset

Trading IS a get rich quick scheme

Don't get grass is greener syndrome

He is staying the course

Don't DM him, DMs are flooded with bots now, just message him on Twitter