No changes this month.

Filtering by Tag: Dirty Dozen Portfolio

Dirty Dozen, Long Only Portfolio, End of October 2017

Two changes at the end of October: selling Tesla (bought last February) and buying Twitter (sold last January).

Dirty Dozen, Long Only Portfolio, End of September 2017

One change this month, getting long Amgen (AMGN) tomorrow (Oct. 2). Why sell it at $139 last November only to buy back at $186 this October? Good question ... and the reason why buy and hold (and forget about it) is so compelling. But look at the exits on Chipotle and Gilead and Starbucks and Twitter ... I don't always get it so wrong.

Dirty Dozen, Long Only Portfolio, End of August 2017

No changes this month ... still the seven longs in place: two from 2015 (Amazon and NVIDIA), three from 2016 (Apple, Google, and Netflix), and two from 2017 (Facebook and Tesla).

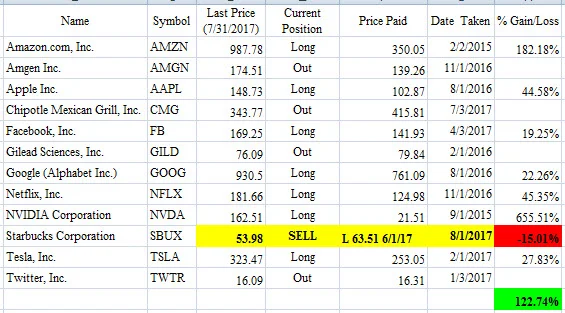

Dirty Dozen, Long Only Portfolio, End of July 2017

Sorry for the delay in posting this ... I've been re-learning how to day trade these last several months and it's hard work, but I think I'm making progress, however slow-going.

One change to the Dirty Dozen portfolio: sold Starbucks (SBUX) on August 1 for a loss (I was worried about it at the end of June). Amgen, Chipotle, Gilead, and Twitter remain on the sidelines for now.

Changes in 2017 include selling Twitter in January, while getting long Chipotle and Tesla in February, Facebook in April, and Starbucks in June. The Chipotle sale last month appears to be well-timed, and we'll see how the Starbucks sale in August looks in time.

Dirty Dozen, Long Only Portfolio, End of June 2017

One change to the Dirty Dozen portfolio, selling Chipotle (CMG) on July 3rd. Amgen, Gilead, and Twitter remain on the sidelines for now. Starbucks, which was bought on June 1, isn't looking particularly well, but we will have to wait another month before deciding whether it should be sold.

Changes in 2017 include selling Twitter in January, while getting long Chipotle and Tesla in February, Facebook in April, and Starbucks in June. The Chipotle sale in July, after five months of holding, will more or less be a "scratch" ... no loss, no gain.

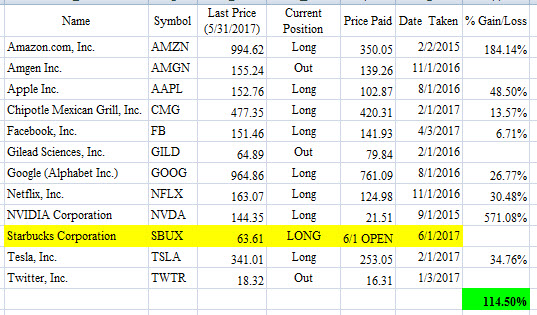

Dirty Dozen, Long Only Portfolio, End of May 2017

One change to the Dirty Dozen portfolio, getting long Starbucks (SBUX) on June 1. Amgen, Gilead, and Twitter remain on the sidelines for now. NVIDIA beat earnings and went quite a bit higher since the last post. Changes in 2017 include getting long Chipotle and Tesla in February and Facebook in April.

Dirty Dozen, Long Only Portfolio, End of April 2017

I introduced the Dirty Dozen portfolio earlier this month. I track a dozen popular stocks using a *monthly* trend following system. It might be interesting to know my take on these stocks if you hold any of them. I did settle on Chipotle as the twelfth stock, which readers overwhelmingly nominated.

- Amazon

- Amgen

- Apple

- Chipotle

- Gilead

- Netflix

- NVIDIA

- Starbucks

- Tesla

There are no changes this month, but NVIDIA is at an interesting point ... it's the second longest-held position and the biggest winner ... it will be telling when the monthly trend finally turns down.

Dirty Dozen, Long Only Portfolio, End of March 2017

I'm going to apply the same trend-following system that I use for my ETF Trading Portfolio to these dozen popular stocks. Sharp readers will notice that there are currently only 11 stocks in the portfolio, so I'm looking for reader suggestions for the twelfth stock (Chipotle maybe?). These are the eleven I came up with so far:

- Alphabet (Google)

- Amazon

- Amgen

- Apple

- Gilead

- Netflix

- NVIDIA

- Starbucks

- Tesla

Unlike the ETF Trading Portfolio, this is a long-only portfolio ... when a stock flips short, I simply close the long position and go to cash. You can see that Facebook and Tesla are the most recent positions put on in April and February, respectively. I plan to update this table at every month end.