The latest addition to my collection of Zippo Armor lighters, "77685," a special order release.

Long Set-up in Activision Blizzard

ATVI was one of the most active things I was watching on Friday morning ... it gapped up big after-hours on Thursday following an earnings report ... unusually active means it gets on my radar looking for idiot wave set-ups, as I've explained in a previous post.

I was visiting a new local casino when it set-up during the lunch hour, so I didn't see it in real time, but it's pretty enough to post here after-the-fact. It didn't hit the target during the day on Friday, but it would have been a fine play to close at end of day and something to keep in mind as we go into next Monday.

Click to enlarge

Long Set-up in Hassenfeld Brothers

HAS first lit up the scanner as it 1) gapped up pre-open (on earnings), 2) made a new yearly high at the open, and 3) became unusually active at the open, then at 9:34 AM, and finally at 10:55 AM. This means I put it on my "idiot wave" watch list, and open the 1-minute, 3-minute, 5-minute, and 15-minute charts on one screen to look for low risk set-ups.

The unusual activity into 10:55 AM was actually a dip which formed a zig zag on the 3-minute which was playable. A masterful (i.e., lucky) entry could have been $93.75 off of the 1-minute chart, but more realistically entry off of the 3-minute would have been $94.14 with the same stop (below $93.30). Target was $96 and high change so the initial risk/reward was acceptable (not great, just ok, gets the green light).

Now this trade didn't work in the end, it was a scratch, no harm, no foul ... but the important thing is the thinking was good, and from the masterful entry you could take something off and carry the rest into the close with a breakeven stop, something like that. I've been out of the game for long enough to be rusty, but I'm just sharing my thoughts, and am happy to hear yours.

Click to enlarge

Chairman Recommended: Slippers

I am almost completely housebound during the winter here in Appalachia and only leave to:

- Take the kids somewhere (school, swimming, art lessons, etc.),

- Buy groceries,

- Play poker.

So my indoor footwear is very important and I use LL Bean's aptly named Wicked Good Scuffs III. I love them because they:

- Have rubber soles,

- Are made from soft sheepskin and are shearling-lined (Australian sheep),

- Are scuffs ("a flat-soled slipper without quarter or heel strap").

I'm at the advanced stage of laziness where all my footwear must be easily slipped on and off, so I slip out of these moccasins and into my slip-on boots when I go outside (to get the paper or put out the trash) and then back in again when I come inside. I wear them all day every day -- highly recommended by the Chairman!

(See this post for my recommended summertime footwear.)

Pretty Set-up in the Biotechs

I'm going to be trading a bit more in 2017 now that baby has started Kindergarten and the house is quieter in the mornings.

Yesterday (1/31/2017) the scanner alerted me to the fact that XBI (the S&P Biotech SPDR) was unusually active around 9:48 AM. I always keep an eye on the recently issued LABU (the Biotech 3x Bull fund based on XBI) these days since it's already fairly liquid and the leverage makes it a decent trading vehicle.

I like to see low risk, high reward set-ups based on the zig-zag "idiot wave pattern," and one thankfully appeared at lunchtime in XBI/LABU off the five minute chart. I might not have been looking as hard at LABU if it hadn't been for that early in the day alert on XBI.

Click to enlarge

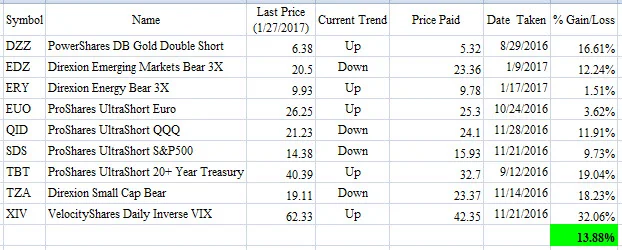

ETF Trading Portfolio Update -- January 30, 2017

No changes this week.

I'll Leave Him Just For You

Love Lucy Rose's Shiver ... great stuff. She was born in 1989.

ETF Trading Portfolio Update -- January 23, 2017

No changes this week.

ETF Trading Portfolio Update -- January 16, 2017

Reversing my longest-held long (Energy) after the holiday.

ETF Trading Portfolio Update -- January 9, 2017

Reversing the Emerging Markets... getting long just in time to get whipsawed?