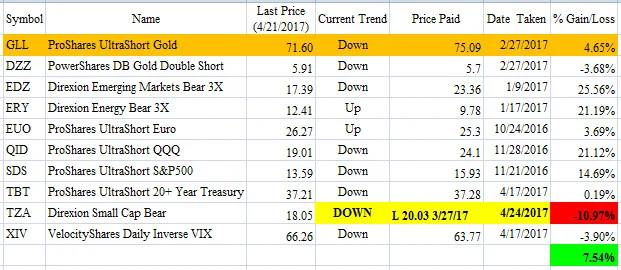

Taking a quick, large loss in the XIV and reversing short (by getting long it) ... and scratching my Euro short and getting long (by selling it short). I know it's confusing, I should change the terminology in the spreadsheet and will try to remember to do so next week.

ETF Trading Portfolio Update -- April 24, 2017

Reversing the short in the small caps and getting long Monday morning.

Looking for Love in a Looking Glass World

The great Bryan Ferry, not diminished by the pencil mustache, in 1976:

Summary of Interview with Trader "AT09"

Here's my bullet-point summary of this interview with a trader named Alex, "AT09"

- 22 years old, trading for three years

- Found penny stock chat room, doesn't say which, Sykes' probably?

- Bought "breakouts" and got "dumped on," lost all his money

- Sold his car rims to fund his second account, total $2,000

- Avoided "Pattern Day Trader" rule with offshore account

- Found new chat room via Twitter, "Investors Underground"

- Discovered that you could sell short, "blew his mind"

- Hooked on shorting after making gains in "VVGL" [since de-listed?]

- "Intoxicated" by making money on the short side, started shorting indiscriminately, bad idea

- Junk companies gapping 100% in summer 2015, "BIOC" "ITEK" "OGEN" "BLPH" "NVAX"

- In the right place at the right time, shorting junk, summer 2015

- Doubled share size from 500 to 1000 shares

- "DRYS" ... company is "complete dogshit," and "toxic"

- Made ~$66K shorting "DRYS," big size and patiently held "long term"

- Account grew to around $10K when he "started finding success," wired excess out

- Once you increase size, you can't go back, taste of large gains too intoxicating

- Made $100K+ in one day: Short "DCIX," "ESEA," "GSL," "SINO" (long and short)

- Can't put size on in "shitty, no volume stocks" ... don't rush it

- First chat room, people were "bullshitting around" [not unlike the poker table]

- Hard to find people who are legit, actually making money [ain't that the truth, Teresa]

- "IPCI" "MCUR" made multiple thousands trading these in a day ["MCUR" since de-listed?]

- Value of watching people with different styles, day traders vs. swing traders

- Seeing how people scale into a trade (on DVD they're selling) is invaluable

- Made $66K on "CLTF" short, summer 2015 [since de-listed?]

- "CraigTrader" taught him to sell/cover half, hold half

- Flipped a house to gain real estate experience, made $30K, took six months, didn't enjoy it

- Made $100K in July 2016 when "small caps came back," doing what he loved

- More of a position trader now since helping with his Dad's small business

- Not a day trader now, can't be in front of screen all day long

- Making more money as swing trader than as a day trader

- Doesn't want to be stressed making $1,000 a day, doesn't want to force things

- Patiently waits for "niche" plays, takes large position, patiently holds

- Wants to hold for weeks on end, save his mental energy, not spend it on day trades

- Follow him on Twitter: AT09

Reviving the Daily Trading Idea

Now that I'm in front of the screen full-time once again, I've decided to revive the Daily Trading Idea newsletter. Every night I send out a trade idea for the following weekday. You can sign up by emailing me at maoxian@gmail.com or filling out the contact form.

The ideas are always simple and straightforward, taken from the daily chart. I'll keep a spreadsheet in Google Sheets that tracks their progress, which anyone can look at at any time. And I plan to share short videos of any day trades I make in the daily trading ideas.

Here's the idea for Monday, April 24, 2017. Short $BIDU. The green line marks the entry area, red line marks the protective stop area, and purple line marks the target area. Sign up by email since I won't be posting these to the blog or Twitter ... it will be a strictly "members only" thing ... free for now, of course.

Click to enlarge

ETF Trading Portfolio Update -- April 17, 2017

Two changes this week... I will be getting long bonds (short TBT) and long volatility (short XIV) on Monday morning, reversing my previous short positions (long TBT from last September and XIV from last November).

Dirty Dozen, Long Only Portfolio, End of March 2017

I'm going to apply the same trend-following system that I use for my ETF Trading Portfolio to these dozen popular stocks. Sharp readers will notice that there are currently only 11 stocks in the portfolio, so I'm looking for reader suggestions for the twelfth stock (Chipotle maybe?). These are the eleven I came up with so far:

- Alphabet (Google)

- Amazon

- Amgen

- Apple

- Gilead

- Netflix

- NVIDIA

- Starbucks

- Tesla

Unlike the ETF Trading Portfolio, this is a long-only portfolio ... when a stock flips short, I simply close the long position and go to cash. You can see that Facebook and Tesla are the most recent positions put on in April and February, respectively. I plan to update this table at every month end.

ETF Trading Portfolio Update -- April 10, 2017

No changes this week.

A Method to His Madness

I have been following this day trader on Twitter for a couple of weeks now. He reveals quite a bit about how he operates and has several dozen videos on YouTube which I found instructive. Let me walk you through his stock selection routine (as I understand it).

He tweets his watch list every morning before the open:

All of these tickers are drawn from the Up Gappers screen using Trade Ideas (an invaluable tool I highly recommend).

GNCMA was a buyout, but I'm not sure why he skipped over GBR. In any event, he put the next six tickers on his watch list. They're all low-float, mostly single-digit priced stocks.

At the open he narrows down the list further by watching what is on the move just after the market opens. Again he uses Trade Ideas for this. Watch his Trade Ideas setup videos (one and two) to understand the filter criteria he uses:

Then at the end of the day he always posts his P&L (which I think is a little nuts since it gives one "performance pressure," but maybe he thrives on it):

So we can see that he did in fact trade BNTC (long), CYCC (long), and DFFN (short). He doesn't generally reveal how much size he's doing and *never* reveals his exact entries and exits (for obvious reasons). Nevertheless it's worth studying his stock selection routine and I recommend you follow him on Twitter if you are a fellow (or aspiring) day trader.

ETF Trading Portfolio Update -- April 3, 2017

No changes this week.