Episode 116 ... Sean Hendelman (65:44)

Good episode ... Hendelman "bursts a lot of bubbles," but he's right on the money, knows of what he speaks.

- University of Michigan grad

- Got an MBA at Stern (NYU)

- Sounds like a New Yorker

- Started on mortgage-backed securities desk

- Greenwich Capital Markets

- 1999 decided to start a trading business

- Started with $50,000, lost within 3-4 months

- Kept at it

- Took him 18 months to get good

- Founded Nexus Capital (2003) -- 40 traders [like an arcade?]

- Read a lot of Peter Lynch in high school

- Interested in trading in 1993-1994, while in high school

- Worked as tennis instructor at country club, made good money (15K a summer)

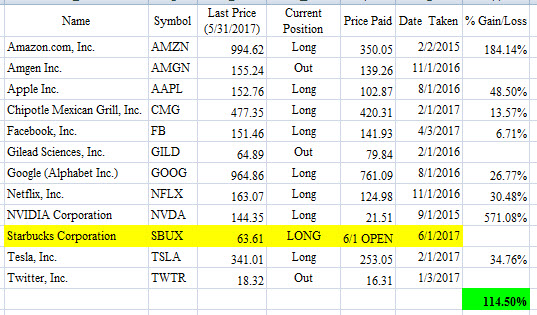

- Bought names he liked (Peter Lynch advice): DELL CSCO MSFT ORCL

- Put all his tennis money ($5-$10K) in each of above stocks, made massive money during dot com bubble

- Luckily took all money out before bubble burst and bought NYC apartment, turned cash poor

- Thought he was a genius

- Made six figures at Greenwich Capital, which was good, able to save

- Expensive to learn how to trade

- SDLI QCOM, buying thousand share lots [Only old guys remember symbols like SDLI, JDSU :)]

- Started hedge fund in 2002-2003, stat arb fund, broke even, expensive to run

- Running $15MM, not enough to make it work, too many expenses

- First $50K loss was a great first learning experience

- Not a math guy, not a programmer, doesn't know C++

- Backs 25% of traders in his firm on prop side, other 3/4 self-fund

- Traders in his firm have all kinds of styles

- T3 name of his firm

- T3 has 1,000 active accounts

- Has two broker-dealers, one prop, one retail

- Need series 57 license to use prop broker-dealer

- T3 makes money on commissions, interest, profit splits

- T3 only caters to active traders, competes with IB and TradeStation

- Holdbacks and payouts of the trader's capital

- Not focused on futures or forex -- don't understand, too much leverage

- T3 can't spend enough money on infrastructure to compete with HFTs anymore

- Co-location of servers, routing, data, compliance, best of the best programmers -- all expensive

- T3's HFT successful 2004 to 2014, now much harder

- HFT very crowded now

- Hudson River, Virtu hired lots of people, built big organizations

- T3 takes liquidity, no passive orders

- 99% of all bids and offers aren't real [yes, I've found this too]

- Flashing and spoofing very common

- HFT never take liquidity at size, would show their hand

- No more low hanging fruit in high frequency trading

- Scott Redler his partner, "Red Dog Reversal," lives highly structured life

- Everything gets priced in very quickly now

- Medium frequency strategies also being priced in very quickly

- Medium frequency not as expensive, no need for co-location, etc.

- Medium frequency traders' success rates very low

- Most don't understand market impact or slippage (+commissions)

- Never backtest, always forward test, use 100 shares, take a few thousand trades, will have realistic market impact data

- Tiny number of medium frequency guys successful and when they are, profits only last a short time [I'm sure he's right]

- CalTech MIT guys are already exploiting every obvious edge

- There are no edges out there ... they have better tech and programmers than you

- Your ideas aren't good enough, someone else already tried and discarded them long ago

- Your ideas after market impact, commissions, paying the spread, won't make money

- Best black box traders are constantly changing, evolving strategies

- 1 in 20 smart traders who try to automate things succeed

- Medium frequency is the same as an active trader

- Will take you a long time and lots of capital to even test your ideas

- Double your commissions and slippage estimates

- Good strategy might have 50% success rate after six months and tweaking

- T3 has 50 strategies running live

- Laughs when people say they didn't run their strategy with real money

- Successful hand traders' pattern recognition still ahead of black boxes

- Momentum traders (buying and selling within minutes) going away, black boxes taken all the profits away

- Good traders don't get excited when they make money

- No emotion with a black box, faster than humans, can prepare well in advance

- Best business advice: Change. Adapt. Don't be afraid to make mistakes. Money in, money out -- positive cash flow

- Best trading advice: Risk management, emotions in check. Preparation.

- Best traders are in the office earliest, reading, adapting to the market

- Don't try to beat the market, you're never going to do it

- www.t3live.com